irwincombs1633

About irwincombs1633

The Allure of Gold: Understanding Gold for Sale And Its Investment Potential

Gold has captivated humanity for centuries, serving not solely as a medium of alternate but in addition as a symbol of wealth, power, and wonder. As one of the crucial sought-after precious metals, gold continues to carry a big place in the global economy and particular person funding portfolios. This article delves into the various facets of gold for sale, including its historical past, sorts, investment potential, and elements influencing its market value.

A quick Historical past of Gold

Gold has been used by civilizations world wide for hundreds of years. The historical Egyptians, as an example, utilized gold in their burial practices, believing it to be a gateway to the afterlife. In addition to its use in jewelry and decoration, gold has been minted into coins, serving as forex for trade. The gold normal, established within the nineteenth century, pegged currency values to a selected quantity of gold, additional entrenching its function in global finance. Though the gold customary is not in apply, gold stays an important asset in the trendy economic system.

Types of Gold for Sale

When considering gold for sale, it’s essential to know the different forms it could take. The primary sorts embrace:

- Gold Bullion: This refers to gold in its purest form, usually produced as bars or ingots. Bullion is measured in troy ounces and is usually 99.99% pure. Buyers usually purchase gold bullion as a hedge against inflation and economic instability.

- Gold Coins: Gold coins are minted by governments and are available in numerous denominations. Popular examples embody the American Gold Eagle, Canadian Gold Maple Leaf, and South African Krugerrand. These coins not solely carry intrinsic worth based on their gold content material but also often have numismatic worth, depending on their rarity and situation.

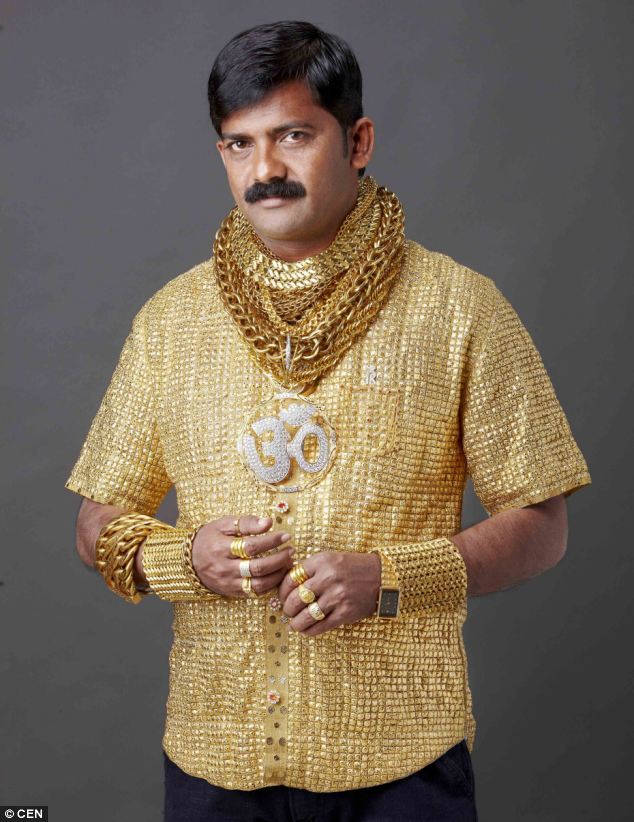

- Gold Jewelry: Whereas gold jewelry is primarily associated with adornment, it can be a form of funding. Should you liked this informative article in addition to you would like to get details about buynetgold generously check out the web page. The worth of gold jewellery is decided by its gold content material, craftsmanship, and brand. Nevertheless, it’s crucial to note that jewellery usually carries a markup attributable to design and labor prices.

- Gold ETFs and Mutual Funds: For individuals who favor not to hold bodily gold, Alternate-Traded Funds (ETFs) and mutual funds that invest in gold mining firms or gold bullion offer a approach to invest in gold indirectly. These financial merchandise provide liquidity and ease of buying and selling, making them a preferred choice among investors.

The Investment Potential of Gold

Investing in gold has a number of benefits. One of the most vital benefits is its function as a protected haven asset. During times of economic uncertainty, geopolitical tensions, or inflation, buyers flock to gold, driving up its worth. This habits has been observed throughout financial crises, such as the 2008 recession and the COVID-19 pandemic.

Furthermore, gold is a tangible asset, that means it has intrinsic value that isn’t dependent on the performance of any single foreign money or monetary system. This high quality makes it a gorgeous option for diversifying an funding portfolio. Monetary experts often recommend allocating a portion of one’s portfolio to gold to mitigate risks associated with stock market volatility.

Components Influencing Gold Prices

The worth of gold is influenced by a variety of things, including:

- Provide and Demand: The fundamental financial precept of provide and demand performs a big role in gold pricing. When demand for gold rises, whether or not for jewellery, industrial use, or investment, costs usually increase. Conversely, if provide outstrips demand, prices could fall.

- Inflation and Currency Worth: Gold is often viewed as a hedge towards inflation. When inflation rises, the buying energy of currency declines, leading investors to turn to gold as a extra stable retailer of worth. Moreover, a weaker U.S. dollar usually ends in higher gold prices, as gold becomes cheaper for investors utilizing different currencies.

- Interest Charges: Curiosity charges have an inverse relationship with gold costs. When curiosity charges are low, the opportunity value of holding gold (which does not yield interest) decreases, making it a more enticing funding. Conversely, higher interest rates can lead to lower gold prices as traders seek better returns elsewhere.

- Geopolitical Events: Political instability, wars, and other geopolitical events can create uncertainty in the financial markets, prompting buyers to flock to gold as a protected haven. Occasions such because the U.S.-China trade struggle and tensions in the Center East have traditionally led to spikes in gold costs.

Where to Buy Gold

For those interested in purchasing gold, there are a number of avenues to explore:

- Respected Dealers: Buying gold from established dealers ensures authenticity and honest pricing. It’s important to research and choose a seller with a solid popularity and positive buyer opinions. Many dealers also supply online buying choices.

- Banks: Some banks promote gold coins and bullion to clients. However, the choice could also be restricted, and costs could be larger than these supplied by specialised dealers.

- Auctions: Gold may also be bought at auctions, the place rare coins and excessive-high quality jewellery could also be accessible. Nonetheless, consumers should be cautious and conduct thorough analysis to avoid overpaying.

- Online Platforms: Numerous on-line platforms enable individuals to buy gold, either in physical kind or through ETFs. It’s essential to ensure that the platform is respected and safe before making a purchase.

Conclusion

Gold stays a timeless investment, offering each allure and safety. Whether or not people need to diversify their portfolios or just recognize the great thing about gold jewellery, understanding the various sorts of gold for sale and the factors influencing its worth is important. As the global economic system continues to evolve, gold will doubtless stay a steadfast asset within the face of uncertainty, making it a worthwhile consideration for buyers of every kind.

No listing found.